How I Stopped Gambling on My Finances — A Real Talk Guide to Smarter Everyday Risk Choices

Ever felt your heart race checking your account after a risky move? I have. For years, I treated my daily finances like a game—until reality hit. What I learned wasn’t from a finance guru, but from real mistakes and slow wins. This isn’t about getting rich quick. It’s about staying safe while growing what you’ve got. Let’s talk honestly about how to size up risks in everyday money moves—without losing sleep. Financial decisions don’t have to feel like bets. With the right mindset and tools, even small choices can build long-term stability. This is a practical guide for anyone who’s tired of second-guessing their spending, saving, or investing—not because they lack knowledge, but because they’ve been misled about what risk really means.

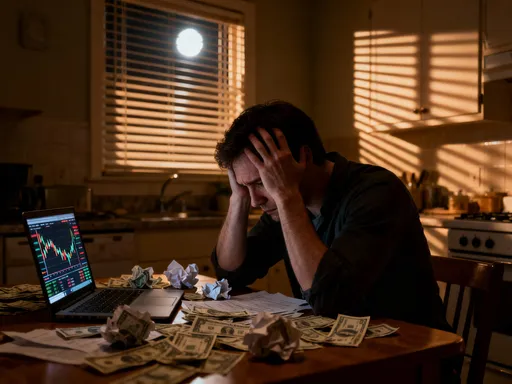

The Wake-Up Call: When “Just Trying Something” Almost Cost Me Everything

There was a time when I believed that if something sounded easy, it probably was. I had worked hard to save a modest amount—nothing extraordinary, just enough to feel secure. Then I heard about a friend’s “investment” in a peer-to-peer lending platform that promised 18% annual returns with “almost no risk.” That phrase—“almost no risk”—should have been my first warning sign, but I wasn’t listening. I moved nearly 70% of my emergency fund into the platform, convinced I was being smart, not reckless. Within six months, the company froze withdrawals. By the time it collapsed, I had recovered less than 30% of what I put in. The financial loss was painful, but the emotional toll was worse. I felt foolish, ashamed, and deeply anxious every time I looked at my bank balance. I had treated my savings like play money, and the consequences were real.

This wasn’t my first misstep, but it was the one that changed me. I began to see how often I had made financial decisions based on emotion—hope, urgency, or the desire to keep up. I wasn’t alone. Many people, especially those managing household budgets or planning for family needs, fall into the same trap. They hear about a “great opportunity” and jump in without asking basic questions: Who’s behind this? What happens if it fails? How long will my money be locked up? These aren’t signs of skepticism—they’re signs of responsibility. What I realized is that risk isn’t reserved for Wall Street traders or tech entrepreneurs. It lives in the everyday choices we make: which bills to delay, whether to co-sign a loan, or how much to spend on a vacation. Ignoring it doesn’t make it disappear—it only makes the fall harder when it comes.

The turning point wasn’t just losing money. It was understanding that I had confused activity with progress. I thought doing something—anything—was better than doing nothing. But in personal finance, inaction can be wiser than impulsive action. That experience taught me to pause, to question, and to prioritize safety over speed. It wasn’t about giving up on growth. It was about redefining what smart growth looks like. Real financial progress isn’t measured in sudden spikes, but in steady, sustainable steps forward. From that moment on, I committed to learning how to assess risk properly—not just for big investments, but for every dollar I touched.

What Risk Really Means in Everyday Money (And Why It’s Not Just About Losses)

When most people hear the word “risk,” they think of losing money. But in personal finance, risk is broader—and more personal—than that. At its core, financial risk is the possibility that things won’t go as planned. It’s not just about numbers on a screen; it’s about how those numbers affect your life. What happens if your side income dries up? What if inflation erodes your savings faster than you expected? What if an unexpected repair forces you to dip into funds meant for retirement? These are not hypotheticals. They are real outcomes that millions of households face every year. Understanding risk means acknowledging that every financial choice comes with trade-offs, and some trade-offs carry heavier consequences than others.

Take the decision to start a side gig. On the surface, it sounds like a win—extra income, new skills, maybe even a path to a career change. But there’s risk involved. What if the gig takes more time than expected, leaving you exhausted? What if the pay is inconsistent, making it hard to budget? What if you invest in equipment or training, only to find the market is oversaturated? These are forms of risk too—opportunity cost, time risk, and income volatility. Similarly, choosing to save money in a traditional savings account may feel safe, but it carries its own risk: inflation erosion. If your savings earn 1% interest while inflation runs at 3%, you’re effectively losing purchasing power every year. Safety and risk aren’t opposites. They’re two sides of the same coin, and every financial decision involves balancing them.

Another common but overlooked risk is emotional spending. This isn’t just about impulse buys at the mall. It’s about making money decisions under stress, loneliness, or excitement. Ever signed up for a subscription during a free trial, only to forget to cancel it? Or lent money to a family member, knowing you might not get it back, because saying no felt too hard? These are emotional risks—choices driven more by feelings than facts. They may not show up on a balance sheet, but they affect your financial health just the same. The key is to recognize that risk isn’t always dramatic. Sometimes, it’s quiet, slow, and cumulative. It’s the small leak that eventually sinks the boat. By naming these everyday risks—liquidity risk, inflation risk, emotional risk—we gain the power to manage them. Awareness is the first step toward control.

Building Your Personal Risk Radar: How to Spot Danger Before It Hits

After my financial setback, I knew I needed a better way to make decisions. I couldn’t rely on gut feelings or what others were doing. I needed a system—a way to pause and assess before committing money to anything. That’s when I developed my personal risk radar, a simple mental checklist I now run through before every financial move. It’s not complicated, but it’s effective. The three core questions I ask myself are: What’s the worst that could happen? Can I recover from it? And how much stress will this cause me? These questions force me to think beyond the immediate reward and consider the full range of possible outcomes.

Let’s say I’m considering a new monthly subscription—a streaming service, a meal kit, or a fitness app. It might seem harmless, but I run it through the radar. What’s the worst that could happen? Maybe I forget to cancel, and it rolls over for months. Maybe the company raises the price unexpectedly. Maybe I don’t use it enough to justify the cost. Can I recover from that? Yes, if it’s a small amount, but if I’m already stretched thin, even $15 a month adds up. And how stressed will this make me? If I have to track multiple subscriptions or worry about hidden fees, that’s a sign it’s not worth the mental load. This same process applies to bigger decisions, like lending money to a relative or investing in a friend’s business. The radar doesn’t tell me what to do—it helps me see what I’m really signing up for.

Another tool I use is the “downside review.” Before saying yes to any financial commitment, I write down the potential downsides in plain language. Not in financial jargon, but in real-life terms: “If this fails, I’ll have to delay my car repair,” or “I’ll feel guilty if I can’t help my sister later.” This practice grounds the decision in reality. It also reveals hidden emotional risks. For example, I once considered co-signing a loan for a cousin. On paper, it seemed manageable. But when I listed the downsides, one stood out: “If they default, I’ll have to cover payments I can’t afford, and our relationship might suffer.” That was enough to make me say no. The risk radar isn’t about avoiding all risk. It’s about choosing risks that align with my values and limits. It’s about making informed decisions, not impulsive ones.

The Stability Framework: Balancing Growth and Safety in Daily Choices

One of the biggest myths in personal finance is that you have to choose between safety and growth. Many people think that if they want to grow their money, they must take big risks. Others believe that safety means keeping everything in a savings account, even if it loses value over time. I’ve come to see that neither extreme works. Instead, I’ve built a Stability Framework—a four-tier system that helps me allocate money based on risk level and purpose. This approach allows me to grow my finances without gambling my security.

The first tier is the Foundation. This is where I keep money I cannot afford to lose—emergency savings, upcoming bills, and essential living expenses. These funds go into low-risk accounts like high-yield savings or short-term CDs. The goal here isn’t high returns; it’s preservation and easy access. I never invest Foundation money in anything volatile. The second tier is the Buffer. This includes funds I can afford to lock up for a few months—like money for a future vacation or a home repair. I might put this into slightly higher-yielding instruments, such as treasury bonds or dividend-paying ETFs, but only if I understand the risks and have a clear exit plan.

The third tier is Growth. This is where I allocate a small portion of my income—typically no more than 10%—to longer-term investments like index funds or retirement accounts. These are not get-rich-quick schemes. They’re disciplined, diversified strategies designed to compound over time. I contribute regularly, regardless of market swings, because I know volatility is part of the process. The fourth tier is Explore. This is my “learning lab”—a space for small experiments with higher risk, like trying a new investment app or putting a tiny amount into a cryptocurrency. I limit this to no more than 5% of my liquid net worth, and I only use money I can afford to lose completely.

This framework gives me structure without rigidity. It allows me to take smart risks while protecting what matters most. I can grow my money without losing sleep, because I know exactly where each dollar belongs. It’s not about avoiding risk—it’s about managing it with intention. Over time, this system has helped me build both financial stability and confidence. I no longer feel torn between caution and opportunity. I’ve found a balance that works for my life.

Real Talk: Why “Everyone’s Doing It” Is the Worst Financial Advice

Social pressure is one of the most powerful—and dangerous—forces in personal finance. I’ve lost count of how many times I’ve made a money decision because I thought, “If everyone else is doing it, it must be safe.” That mindset led me to join a group investment in a real estate crowdfunding platform. Everyone in the group seemed confident. The pitch was smooth. The projected returns were impressive. But I didn’t do my own research. I trusted the crowd. Six months later, the project stalled, and we were told to wait. Some people lost thousands. I was lucky to get my money back, but the experience was a wake-up call. Popularity does not equal safety. In fact, when something becomes a trend, the risk often increases—especially if people are jumping in without understanding the downsides.

FOMO—fear of missing out—distorts judgment. It makes us overlook red flags and downplay uncertainty. We see friends posting about their “wins” on social media, but we rarely hear about their losses. We watch ads that promise “easy money” with phrases like “limited time offer” or “don’t get left behind.” These are not invitations—they’re pressure tactics. Real financial strength comes from independence, not imitation. It means having the courage to say, “This doesn’t fit my plan,” even when others are rushing in.

One of the most important lessons I’ve learned is to question urgency. If a financial opportunity requires an immediate decision, that’s often a sign to walk away. Legitimate investments don’t vanish overnight. Reliable products don’t need countdown timers. I now treat urgency as a warning signal. I also watch for vague promises—phrases like “high returns with minimal effort” or “guaranteed growth.” These are almost always too good to be true. Another red flag is the lack of a clear exit strategy. If I can’t easily get my money back, or if the terms are confusing, I don’t proceed. Real financial progress doesn’t depend on trends. It depends on consistency, clarity, and self-awareness. When I stopped following the crowd, I started making decisions that actually served me.

Tools That Actually Help (No Hype, Just What Works)

There’s no shortage of financial apps, courses, and gurus promising to transform your money life. But most of them overcomplicate things or sell false hope. What I’ve found is that the most effective tools are simple, low-cost, and easy to use. They don’t require a subscription or a degree in finance. They just require discipline. The first tool I rely on is a risk journal. It’s not fancy—just a notebook or a digital document where I write down every financial decision I’m unsure about. I note the option, the potential upside, the worst-case scenario, and how I feel about it. This practice slows me down and creates space for reflection. Over time, I’ve noticed patterns—certain triggers that make me take bigger risks than I should, like stress or social comparison.

Another tool is the 24-hour pause rule. If I’m considering a financial move that feels exciting or urgent, I wait at least one full day before acting. This simple delay has saved me from countless impulse decisions. During that time, I revisit my risk radar and my Stability Framework. I ask myself: Does this align with my goals? Can I afford the downside? Is this really necessary? Often, the urgency fades, and I realize the decision wasn’t as critical as it first seemed. For example, I once wanted to upgrade my phone because a new model was released. After waiting 24 hours, I realized my current phone worked fine, and the upgrade would strain my budget. I kept what I had—and saved hundreds.

A third tool is the “stress test” conversation. Before making any significant financial move, I talk to a trusted person—a friend, a sibling, or a financial advisor—and walk them through my reasoning. I don’t ask for permission. I ask for feedback. I say, “Here’s what I’m thinking. What am I missing?” This conversation often reveals blind spots. It also holds me accountable. Knowing I’ll have to explain my decision makes me think more carefully. These tools—journaling, pausing, and talking—aren’t flashy, but they’re effective. They keep me grounded, focused, and in control. They’ve turned my financial decision-making from a gamble into a practice.

Owning Your Financial Peace: Making Risk Work for You, Not Against You

Looking back, I can see that my journey wasn’t just about recovering lost money. It was about rebuilding trust—in myself, in my choices, in the process. I used to think financial success was about making bold moves or catching the next big trend. Now I know it’s about consistency, clarity, and calm. I’ve learned that real wealth isn’t just a number in an account. It’s the quiet confidence that comes from knowing you have a plan, that you can handle setbacks, and that you’re not at the mercy of the next shiny offer.

Risk will always be part of personal finance. Avoiding it completely isn’t possible—or even desirable. Some level of risk is necessary for growth. But the goal isn’t to eliminate risk. It’s to choose it wisely. It’s to move from blind gambling to intentional decision-making. My Stability Framework, my risk radar, and my simple tools have given me that power. They’ve helped me shift from reacting to planning, from fearing mistakes to learning from them.

For anyone who’s ever felt overwhelmed by money choices, I want to offer this: You don’t need to be an expert. You don’t need to chase every opportunity. You just need a few good principles and the courage to stick with them. Financial peace isn’t found in quick wins. It’s built slowly, choice by choice, through habits that prioritize safety, awareness, and long-term thinking. When you stop gambling with your finances, you start building something far more valuable—a life of stability, freedom, and quiet confidence. That’s the real win.