How I Navigated Financial Recovery While Funding My Healing Journey

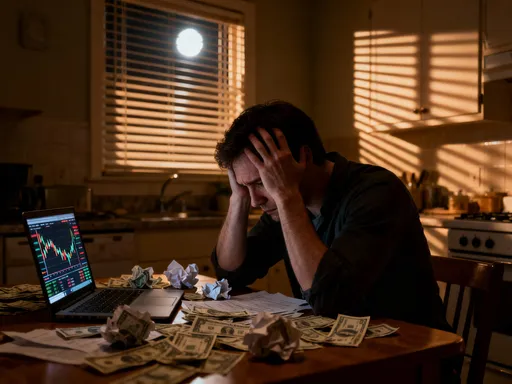

Recovering from a health setback isn’t just about physical healing—it hits your wallet too. I learned this the hard way when medical bills piled up and my income slowed. But instead of panicking, I rebuilt my finances with simple, smart investment moves that supported my recovery. This is how I balanced healing and financial stability, step by step, with strategies that actually work when money feels tight and uncertain. It wasn’t about getting rich quickly or taking bold risks. It was about making thoughtful choices that protected what I had, allowed for gradual growth, and reduced the constant anxiety that comes with financial uncertainty during a time when energy and focus are already stretched thin. Healing demands peace of mind, and peace of mind starts with a plan.

The Hidden Cost of Healing: When Health Crises Become Financial Ones

When illness or injury strikes, the immediate concern is almost always physical recovery. Doctors, treatments, medications, and therapy schedules dominate the conversation. Rarely does anyone prepare for the silent burden that follows—the financial strain. Yet for millions of people, a health crisis quickly evolves into a financial crisis. Medical bills, even with insurance, can accumulate rapidly. Co-pays, deductibles, prescription costs, and expenses for specialized equipment or home modifications add up in ways that are difficult to anticipate. What many don’t realize is that the indirect costs often outweigh the direct ones. Lost income due to reduced work hours or temporary disability can erode savings in a matter of months. Travel to see specialists, hiring help for household tasks, and even nutritional supplements not covered by insurance become necessary line items in a budget that wasn’t designed for them.

Consider the case of a woman recovering from a joint replacement surgery. The procedure itself may be covered, but physical therapy three times a week for three months, plus the cost of a temporary stair lift and a month of reduced work hours, can easily amount to several thousand dollars. These expenses are not luxuries—they are essential to recovery—but they are rarely factored into personal financial planning. The emotional toll of managing pain and fatigue is compounded by the stress of watching bank balances shrink. Studies have shown that medical expenses remain one of the leading causes of financial distress, even in households with stable incomes and insurance. The danger lies in treating financial health as secondary to physical health, when in reality, the two are deeply intertwined. Without financial stability, access to quality care, nutritious food, and a supportive environment can be compromised, slowing recovery and increasing the risk of setbacks.

What makes this financial spiral so insidious is its gradual nature. It doesn’t happen overnight. A missed paycheck here, an unexpected bill there—each feels manageable in isolation. But over time, these small drains erode financial resilience. Emergency funds dwindle, credit card balances rise, and the sense of control fades. This is why addressing the financial impact of healing must be part of the recovery process from the beginning. It’s not about cutting corners on care, but about being proactive—mapping out potential costs, identifying sources of support, and adjusting financial habits to match the new reality. Recognizing that financial recovery is not separate from physical recovery, but a critical component of it, is the first step toward regaining stability.

Shifting Mindset: From Survival Mode to Strategic Investing

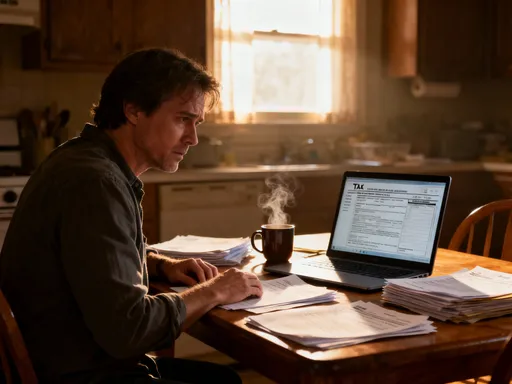

In the early months of my recovery, my financial focus was purely defensive. I was in survival mode—cutting expenses, deferring payments, and living paycheck to paycheck. It felt like all I could do to keep my head above water. But as the weeks passed, I began to realize that surviving wasn’t the same as healing. I was so focused on avoiding disaster that I wasn’t building anything positive. That’s when I started to question the assumption that investing was something only for people with stable incomes and no medical bills. I had always thought of investing as a luxury, something you did after all your debts were paid and your savings were secure. But what if that timeline was backward? What if strategic, modest investing could actually be a tool for regaining control, not just a reward for having it?

This mental shift didn’t happen overnight. It began with a simple realization: financial healing doesn’t require large sums of money. It requires consistent, intentional action. I started small—setting aside just $25 a week into a low-cost index fund. It wasn’t much, but it represented a commitment to the future, even in the present uncertainty. That small act changed my relationship with money. Instead of seeing my finances as a source of stress, I began to see them as a space where I could still make progress. The act of investing, no matter how small, restored a sense of agency. It reminded me that I wasn’t powerless. I wasn’t building wealth quickly, but I was building resilience. And that made a difference in how I approached each day.

This mindset shift is supported by behavioral finance research, which shows that taking even minor financial actions can improve psychological well-being. When people feel they are moving forward, even slowly, their stress levels decrease and their decision-making improves. For someone in recovery, this is crucial. Mental and emotional energy are limited resources. Wasting them on financial anxiety reduces the capacity for physical healing. By reframing investing as a form of self-care—a way to protect future stability—I was able to integrate it into my recovery plan without adding pressure. It wasn’t about chasing high returns or outsmarting the market. It was about creating a quiet, reliable process that worked in the background, much like physical therapy rebuilt strength over time. The lesson here is clear: financial recovery begins with belief. You have to believe that you are worth investing in, even when you’re not at your strongest.

Building a Foundation: Safety First, Growth Second

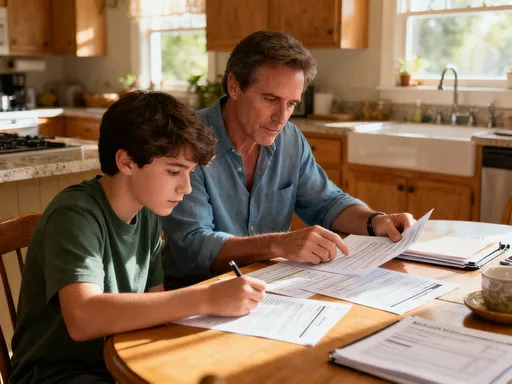

Before I made any moves toward investing, I took a hard look at my financial foundation. I knew that chasing growth without stability was like trying to run before learning to walk. My first priority was to protect what I had. This meant creating a lean, realistic budget that reflected my current income and essential expenses. I categorized everything: housing, utilities, groceries, medical costs, insurance premiums, and minimum debt payments. Non-essentials were temporarily suspended. I also reviewed my emergency fund, which had been partially depleted. Instead of trying to refill it to the traditional three-to-six-month guideline all at once, I set a more achievable target—a three-month cushion for basic living expenses, adjusted for my reduced income.

With that foundation in place, I turned to asset allocation. I chose low-risk, liquid investments for the majority of my available funds. High-yield savings accounts and short-term certificates of deposit became my go-to options. These aren’t glamorous, but they serve a critical purpose: capital preservation. When your income is unpredictable, the last thing you want is to lose money to market volatility. I treated this phase like financial first aid—stabilizing the situation before attempting any long-term growth. I also made sure that my emergency fund was kept separate from any investment accounts, ensuring it wouldn’t be accidentally accessed or exposed to risk.

This conservative approach wasn’t about fear. It was about strategy. By securing my base, I reduced the pressure to make hasty decisions later. I knew that if another unexpected expense arose, I wouldn’t have to sell investments at a loss or take on high-interest debt. This sense of security allowed me to invest the remainder with greater confidence. I allocated a small portion—no more than 20% of my investable assets—to slightly higher-risk options, but only after the foundation was solid. The principle was simple: safety enables growth. You can’t build a strong financial future on a shaky foundation. For anyone navigating recovery, this order of operations is essential. Protect first. Grow later. The returns may be modest in the short term, but the peace of mind is invaluable.

Smart, Simple Investing: Tools That Work Without Adding Stress

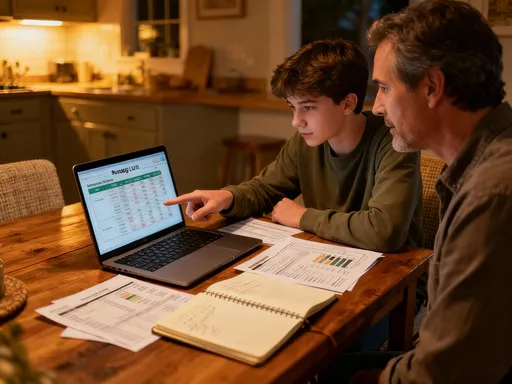

Once my financial base was stable, I began exploring ways to grow my money without adding mental or emotional strain. I knew I couldn’t afford to spend hours monitoring the markets or analyzing stock picks. My energy was needed elsewhere. So I looked for investment tools that were simple, automated, and reliable. Index funds quickly became my top choice. These funds track broad market averages, like the S&P 500, and offer instant diversification. Because they are passively managed, they have lower fees than actively managed funds, which means more of my money stays invested. I chose a low-cost provider and set up automatic transfers of $50 per month. It wasn’t a large amount, but it was consistent. Over time, compounding began to work in my favor, even with modest contributions.

Dividend-paying stocks were another option I explored. These are shares in companies that distribute a portion of their profits to shareholders on a regular basis. The income isn’t huge, but it provides a small, steady stream of cash that can be reinvested or used to cover minor expenses. I focused on established companies with a history of stable dividends, avoiding high-risk sectors. This wasn’t about speculation; it was about reliability. The dividends acted like a financial safety net, offering a small but predictable return regardless of market conditions.

I also used micro-investing apps that round up everyday purchases and invest the spare change. For example, if I bought groceries for $47.35, the app would round it up to $48 and invest the $0.65 difference. It sounds trivial, but over time, these small amounts added up. The best part was that it required no effort. It happened automatically, without me having to think about it. These tools were designed for people with limited time, energy, or financial knowledge, and they worked precisely because they removed the complexity. They allowed me to participate in the market without feeling overwhelmed. The key was consistency, not size. By making investing a seamless part of my routine, I turned it into a habit—one that supported my recovery by reducing financial stress and building long-term security.

Balancing Risk: Protecting Yourself Without Playing It Too Safe

There’s a common misconception that avoiding risk is always the safest choice. But in finance, that’s not always true. In fact, being too conservative can expose you to other dangers—particularly inflation. Over time, inflation erodes the purchasing power of money. If your savings are sitting in a low-interest account, they may technically be “safe,” but their real value is shrinking. That’s why a balanced approach to risk is essential, especially during recovery. The goal isn’t to avoid all risk, but to manage it wisely. This is where diversification becomes a powerful tool. It’s not just a buzzword; it’s a practical strategy for reducing vulnerability.

I applied this principle by spreading my investments across different asset classes. A portion went into index funds, another into dividend stocks, and a small amount into bonds. This mix helped smooth out volatility. When one area underperformed, others often held steady or improved. It was like not putting all my medications in one bag—if one were lost, I wouldn’t lose everything. Diversification doesn’t eliminate risk, but it reduces the impact of any single loss. I also avoided concentrating my investments in a single industry or company, which could be devastated by a single event. Instead, I opted for broad exposure, which historically has delivered more stable long-term returns.

Another aspect of risk management was time horizon. I reminded myself that recovery is a journey, not a sprint. Some investments were meant for the short term—like my emergency fund—and needed to be accessible and secure. Others were for the long term, where I could afford to ride out market fluctuations. This distinction helped me make better decisions. For example, I didn’t panic when the market dipped, because I knew I wouldn’t need that money for years. I also avoided high-fee products and complex derivatives that promised high returns but carried hidden risks. Simplicity was my guide. By balancing caution with progress, I protected my finances without freezing them in place. The result was a portfolio that was resilient, adaptable, and aligned with my goals.

Earning While Healing: Side Streams That Fit Your Energy Level

One of the hardest parts of recovery is the loss of income. Even with savings and investments, there’s a psychological and practical need to contribute. I found that earning a small amount of money, even part-time, made a big difference in how I felt. But I had to be honest about my energy levels. Full-time work was out of the question, and I didn’t want to risk burnout. So I looked for ways to generate income that matched my physical capacity. The key was flexibility and low effort. I explored passive income streams first—digital products like printable planners and wellness guides that I could create once and sell repeatedly. I used free platforms to host and distribute them, minimizing upfront costs.

I also took on light freelance work—writing articles, editing documents, and managing social media for small businesses. These tasks could be done from home, on my own schedule, and in short bursts. I set strict boundaries: no more than two hours a day, and only on days when I felt up to it. This wasn’t about maximizing income; it was about maintaining momentum. The money earned wasn’t huge, but it covered things like insurance premiums, therapy co-pays, or small investment contributions. More importantly, it restored a sense of purpose. I wasn’t just waiting to get better—I was moving forward.

Another option was renting out underused assets. I had a spare room that I occasionally rented through a trusted platform. I also lent out equipment like a high-quality camera and gardening tools when I wasn’t using them. These weren’t full-time ventures, but they generated extra cash with minimal effort. The lesson was clear: earning during recovery isn’t about doing more—it’s about doing what you can, within your limits. When income efforts are aligned with energy levels, they support healing instead of hindering it. And over time, these small streams can add up to meaningful financial relief.

The Long Game: Turning Recovery Into a Financial Fresh Start

Looking back, I see that my health crisis, while incredibly difficult, became a catalyst for lasting financial change. It forced me to confront habits I had ignored, priorities I had misplaced, and systems that weren’t working. But it also gave me the opportunity to rebuild—this time with greater clarity and intention. The strategies I developed weren’t just about surviving a tough period; they became the foundation of a more resilient financial life. I now budget with flexibility, invest with consistency, and earn with balance. I’ve learned that progress isn’t measured in big leaps, but in small, steady steps.

More than that, I’ve developed a mindset that views financial health as an ongoing practice, not a one-time achievement. I no longer see investing as something distant or intimidating. It’s a daily choice—a way to honor my future self. The same patience and discipline I applied to physical therapy, I now apply to my finances. And just as healing takes time, so does financial recovery. But both are possible with the right approach. What started as a crisis became a transformation. I didn’t just return to where I was before. I built something stronger, smarter, and more sustainable. For anyone facing a similar journey, the message is this: you are not alone, and you are not powerless. With careful planning, realistic goals, and compassionate self-awareness, it is possible to heal your body and your finances at the same time. Recovery isn’t just about getting back—it’s about building forward.