How I Built a Bulletproof Portfolio Without Losing Sleep

What if you could grow your money while staying safe when markets go wild? I used to stress over every dip—until I learned how to balance risk the smart way. It’s not about avoiding losses completely; it’s about being ready. This is how I structured my assets to protect what I’ve built, stay on track toward my goals, and actually enjoy the journey. No hype, no gamble—just practical, tested strategies. The truth is, financial security isn’t reserved for experts or the wealthy. It’s available to anyone willing to think ahead, act with discipline, and accept that volatility is part of the process. The real goal isn’t to outrun every downturn. It’s to build a portfolio that can absorb shocks, adapt when needed, and keep moving forward—no matter what the market throws your way.

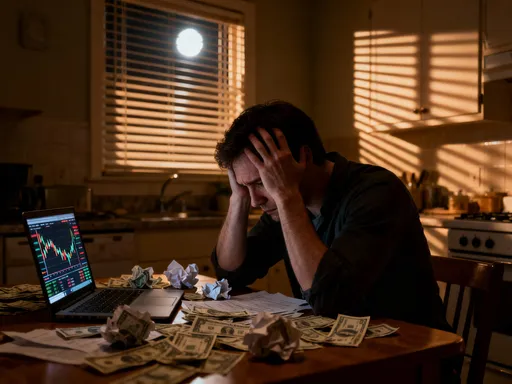

The Wake-Up Call: Why Risk Hits Harder Than We Expect

In 2008, like many others, I watched my retirement account shrink by nearly 40 percent in less than a year. I had invested heavily in growth stocks, drawn in by strong returns over the previous five years. I believed the market would keep rising, and I ignored warning signs—rising debt levels, overheated housing markets, and tightening credit. When the crash came, I froze. By the time I sold, it was too late. The damage was done. More than the financial loss, what stayed with me was the emotional toll. I lost sleep. I argued with my spouse about money. I questioned every financial decision I had ever made. That experience changed my relationship with investing forever. I realized I had confused confidence with competence. I thought I was building wealth when I was actually building risk.

The truth is, most people underestimate how deeply financial loss affects their lives. It’s not just about numbers on a screen. It’s about peace of mind, family stability, and long-term goals like retirement or funding a child’s education. When we fail to plan for risk, we expose ourselves to more than market swings—we expose our future. Chasing high returns without considering downside protection is like driving fast on icy roads without seatbelts. It might feel thrilling at first, but one slip can change everything. I learned that growth without guardrails is not progress; it’s gambling in disguise. And gambling has no place in long-term financial planning.

What shifted my thinking was understanding that sustainable wealth isn’t built in a single year of high returns. It’s built over decades of consistent, thoughtful decisions. The goal isn’t to win every quarter—it’s to survive every crisis. That means designing a portfolio that doesn’t collapse when fear takes over the market. It means accepting that some years will be flat or negative, but knowing your structure will help you recover. This mindset shift—from chasing performance to managing risk—was the foundation of everything that followed. I stopped asking, “How much can I make?” and started asking, “How much can I afford to lose?” That single question changed my entire approach.

Asset Allocation Isn’t Boring—It’s Your Financial Backbone

Many people think asset allocation is a topic for financial advisors with spreadsheets, not for everyday investors. But in reality, it’s the most powerful tool most people already have. Asset allocation simply means dividing your money among different types of investments—stocks, bonds, cash, and alternatives—based on your goals, timeline, and comfort with risk. It’s not about picking the next hot stock. It’s about creating a structure that supports your long-term financial health. Studies have shown that over 90 percent of portfolio returns over time are explained by asset allocation, not stock-picking or market timing. That means how you divide your money matters far more than which specific funds or companies you choose.

To see why this matters, consider two investors during the 2008 crisis. Investor A had 100 percent in U.S. stocks. When the market dropped, their portfolio lost nearly half its value. Investor B had a balanced mix—60 percent stocks, 30 percent bonds, 10 percent cash. Their stock holdings also fell, but bonds held steady and even rose in value as interest rates dropped. The overall loss was around 20 percent—painful, but manageable. More importantly, Investor B didn’t panic. They had expected some volatility and had a plan. When markets began to recover, they were still invested and ready to benefit. Investor A, on the other hand, had sold at the bottom and missed the rebound. The difference wasn’t intelligence or access to better information. It was structure.

Each asset class behaves differently under stress. Stocks offer growth potential but come with higher volatility. Bonds tend to be more stable and can provide income, especially when stocks fall. Cash offers safety and liquidity, allowing you to wait for better opportunities. Alternatives like real estate or commodities can provide diversification, though they come with their own risks. The key is not to rely on any single asset class but to combine them in a way that balances growth and protection. This is where many people go wrong—they treat allocation as a one-time decision. They set it up when they open an account and never look again. But life changes. Markets change. Your portfolio should reflect that.

That’s why active rebalancing is essential. Over time, some investments grow faster than others, shifting your original mix. If stocks perform well for several years, they might grow from 60 percent of your portfolio to 80 percent—increasing your risk without you realizing it. Rebalancing means selling some of the winners and buying more of the underperformers to return to your target allocation. It’s a disciplined way to “buy low and sell high” without trying to time the market. It may feel counterintuitive—selling what’s working and buying what isn’t—but it’s one of the most reliable ways to manage risk over time. Asset allocation isn’t exciting, but it’s effective. It’s the quiet foundation that allows you to sleep at night, even when the financial news is anything but calm.

Diversification Done Right: Beyond Just Spreading Your Money

Many investors believe they are diversified because they own multiple stocks or funds. But true diversification goes much deeper. Owning ten technology stocks isn’t diversification—it’s concentration in one sector. If the tech industry faces a downturn, all ten holdings could fall together. Real diversification means spreading your investments across different sectors, industries, countries, and asset types in a way that reduces overall risk. The goal is not to own more things, but to own things that don’t move in the same direction at the same time. When one part of your portfolio struggles, another part may hold steady or even gain, helping to smooth out your returns.

Consider what happened during the European debt crisis in 2011–2012. Investors heavily focused on European banks and government bonds saw significant losses. But those with exposure to U.S. and Asian markets, along with non-financial sectors like healthcare and consumer goods, experienced much milder effects. Geographic diversification played a crucial role. Similarly, during the pandemic market shock in early 2020, travel and energy stocks collapsed, but technology and healthcare sectors surged. A portfolio concentrated in one area would have suffered greatly, while a globally diversified one was better protected. These examples show that diversification isn’t about avoiding loss entirely—it’s about preventing catastrophic loss.

Building true diversification starts with assessing your current holdings. Look beyond fund names and marketing terms. Ask: What sectors do my investments represent? Are they mostly in one country or spread across regions? Do they rely on similar economic conditions to perform? A simple audit can reveal hidden risks. For example, you might think you’re diversified because you own three mutual funds, only to discover they all track the same large-cap U.S. index. That’s not diversification—it’s duplication. To improve, consider adding exposure to international markets, small-cap companies, real estate investment trusts (REITs), or bond funds with different maturities and credit qualities.

The most effective diversification also considers correlation—the degree to which different investments move together. The lower the correlation, the better the risk reduction. Gold, for instance, often moves independently of stocks and can act as a hedge during times of inflation or uncertainty. Long-term government bonds may rise when stocks fall, providing balance. The goal is to build a portfolio where no single event can wipe out your progress. This doesn’t mean owning everything. It means owning a thoughtful mix that aligns with your goals and risk tolerance. Diversification isn’t a set-it-and-forget-it strategy. It requires periodic review and adjustment as markets evolve and your life changes. But when done right, it becomes one of your most powerful tools for long-term financial resilience.

Hedging Without Complexity: Simple Moves That Actually Work

When people hear the word “hedging,” they often think of complex financial instruments like options or futures—tools used by traders on Wall Street. But effective hedging doesn’t have to be complicated. For everyday investors, hedging simply means taking practical steps to reduce risk without sacrificing long-term growth. The best hedges are simple, low-cost, and easy to maintain. They don’t promise to eliminate all losses, but they do help soften the blow when markets turn volatile.

One of the most effective hedges is a well-structured bond portfolio. Unlike stocks, high-quality bonds—especially government and investment-grade corporate bonds—tend to hold their value or even increase during market downturns. When investors panic and sell stocks, they often move into bonds, driving prices up. This inverse relationship provides a natural buffer. A bond ladder—where you hold bonds with different maturity dates—can enhance this benefit. As each bond matures, you can reinvest the proceeds at current rates, protecting against interest rate swings while maintaining a steady income stream. This strategy doesn’t require timing the market. It just requires planning and consistency.

Another powerful hedge is maintaining a cash reserve. Many investors see cash as “dead money” because it earns little to no return. But cash has a strategic role. It provides liquidity during downturns, allowing you to avoid selling investments at a loss. Imagine facing a job loss or unexpected medical bill during a market crash. Without cash on hand, you might be forced to sell stocks at their lowest point, locking in losses. With a cash cushion—typically three to six months of living expenses—you can wait for markets to recover before making any moves. Cash also gives you the flexibility to buy quality assets at discounted prices when others are panicking. In that sense, cash isn’t idle—it’s ammunition.

Some investors try to hedge with exotic strategies—leveraged ETFs, short positions, or complex derivatives. These tools often increase risk rather than reduce it. They can be expensive, hard to understand, and prone to unexpected outcomes. For most people, simplicity wins. Defensive sectors like utilities, consumer staples, and healthcare also act as natural hedges. These industries provide essential goods and services, so their earnings tend to be stable even in recessions. Including a portion of these in your portfolio can help maintain balance when cyclical sectors struggle. The key is to focus on strategies that are reliable, transparent, and aligned with your overall plan. Hedging isn’t about predicting the future. It’s about preparing for uncertainty—and doing so in a way that doesn’t create new risks.

Risk Tolerance vs. Reality: What Your Gut Ignores

When financial advisors ask about your risk tolerance, they often use questionnaires that ask how you’d feel if your portfolio dropped 10, 20, or 30 percent. Most people say they can handle it—until it actually happens. The truth is, there’s a big gap between how we think we’ll react to loss and how we actually react. Behavioral studies show that the pain of losing $1,000 feels about twice as strong as the pleasure of gaining the same amount. This “loss aversion” means that even well-constructed portfolios can be derailed by emotional decisions if the investor isn’t truly prepared for volatility.

Many people overestimate their risk tolerance when markets are rising. They see gains and feel confident. But when losses appear, fear takes over. The most common mistake is panic selling—selling investments after a drop, locking in losses, and missing the recovery. Another is FOMO, or fear of missing out, which leads people to chase hot trends near market peaks, often buying high and selling low. Recency bias—the tendency to assume recent patterns will continue—fuels both behaviors. After a long bull market, people assume stocks will keep going up forever. After a crash, they assume the market will never recover. These emotional traps can undo years of disciplined saving and investing.

To build a portfolio that truly matches your risk capacity, you need to look beyond feelings. Start by assessing your financial situation. How long is your investment horizon? If you’re 30 years from retirement, you can afford more volatility than someone who needs the money in five years. Do you have a stable income and emergency savings? If not, taking on high risk could jeopardize your basic financial security. These factors determine your true risk capacity—the amount of risk you can afford to take, not just the amount you think you can handle emotionally.

One practical tool is to simulate past market events. Look at how your current portfolio would have performed during the 2008 crash or the 2020 pandemic drop. Could you have stayed invested? Would the losses have forced you to change your plans? If the answer is no, your portfolio may be too aggressive. Another approach is to start with a more conservative allocation and gradually increase risk as you gain experience and confidence. The goal isn’t to eliminate fear—some level of discomfort is normal. It’s to ensure your portfolio doesn’t push you into making irreversible mistakes. Aligning your investments with both your financial reality and emotional limits is what allows you to stay the course, even when the market tests your resolve.

Rebalancing: The Discipline That Keeps You on Track

Over time, even a well-designed portfolio can drift from its original strategy. This happens naturally as different investments perform at different rates. Stocks may outperform bonds, increasing their share of your portfolio. A single sector might surge, creating an unintended concentration. Without intervention, what started as a balanced plan can become a high-risk bet. This is where rebalancing comes in. Rebalancing means periodically adjusting your portfolio back to your target allocation. It’s a disciplined way to manage risk and maintain your long-term strategy without trying to predict market movements.

Imagine you set your portfolio at 60 percent stocks and 40 percent bonds. Over three years, stocks perform well, growing to 75 percent of your portfolio. While that sounds good, it also means you’re now taking on more risk than intended. If the market corrects, your losses could be larger than expected. Rebalancing would involve selling some stocks and buying bonds to return to your 60/40 target. It forces you to sell high and buy low—a principle that’s easy to understand but hard to execute emotionally. Most people do the opposite—buying more of what’s rising and selling what’s falling. Rebalancing automates the right behavior.

There are two main approaches: time-based and threshold-based. Time-based rebalancing means reviewing your portfolio at regular intervals—once a year, for example. This keeps the process simple and routine. Threshold-based rebalancing means acting when an asset class moves beyond a certain percentage—say, 5 or 10 points—from its target. This method responds to market moves more quickly but may require more attention. Many investors use a combination: an annual review with adjustments made if allocations have strayed too far.

One concern people have is taxes. Selling assets in a taxable account can trigger capital gains. To address this, consider rebalancing within tax-advantaged accounts like IRAs or 401(k)s first, where trades don’t create tax consequences. You can also use new contributions to buy underweight assets instead of selling overweight ones. For example, if bonds are below target, direct new investments into bond funds until balance is restored. This method avoids sales altogether. Over time, consistent rebalancing has been shown to modestly improve returns while reducing risk. It’s not a flashy strategy, but it’s one of the most reliable ways to stay aligned with your goals and avoid drifting into danger without realizing it.

Putting It All Together: Building Your Personal Risk-Proof Plan

Creating a bulletproof portfolio isn’t about finding a magic formula. It’s about combining proven principles—asset allocation, diversification, hedging, and rebalancing—into a coherent, personal strategy. Start by defining your goals. Are you saving for retirement in 30 years? A child’s education in 10? A home purchase in 5? Each goal has a different timeline and risk profile. Then, assess your risk capacity—how much volatility you can afford based on your income, savings, and financial obligations. This will guide your asset allocation.

Next, build diversification across and within asset classes. Use low-cost index funds or ETFs to gain broad exposure to U.S. and international stocks, different bond types, and possibly real assets like REITs. Avoid overconcentration in any single company, sector, or country. Include natural hedges like high-quality bonds, defensive sectors, and a cash reserve. These aren’t meant to generate high returns—they’re there to protect your portfolio when markets are stressed.

Set a rebalancing schedule—annual is often sufficient—and stick to it. Automate contributions and use new money to adjust allocations when possible. Review your portfolio regularly, but don’t obsess over daily moves. The market will fluctuate. That’s normal. What matters is that your structure remains intact. For example, a sample portfolio for someone in their 40s with a moderate risk tolerance might include 50 percent in a mix of U.S. and international stocks, 35 percent in bonds of varying maturities, 10 percent in real estate or alternatives, and 5 percent in cash. As they near retirement, they can gradually shift toward more bonds and less stocks to reduce risk.

The habits that sustain long-term success are simple but powerful: consistency, discipline, and patience. Avoid the noise of financial media and the lure of quick gains. Focus on what you can control—your savings rate, your costs, your behavior. Wealth isn’t built in a single year of high returns. It’s built over decades of staying the course. The most successful investors aren’t the ones who pick the best stocks. They’re the ones who avoid the worst mistakes. They don’t try to time the market. They don’t panic when others do. They have a plan, and they stick to it. That’s not luck. That’s design. And it’s available to anyone willing to put in the effort. In the end, financial peace isn’t about having the most money. It’s about knowing you’re prepared—no matter what comes next.