How I Kept My Cool When the Paycheck Stopped — And What I Did With My Investments

Losing a job doesn’t just hurt your wallet—it shakes your confidence, especially when you’re staring at your investment portfolio wondering what to do next. I’ve been there. When my income vanished overnight, panic kicked in. But instead of selling everything or doubling down blindly, I focused on timing and temperament. This is how I adjusted my investment rhythm, protected my savings, and stayed sane through the storm—without making costly emotional moves. What followed wasn’t a quick fix, but a deliberate, thoughtful recalibration of how I managed money when stability disappeared. It wasn’t about chasing returns. It was about preserving peace of mind and long-term financial health. This is the strategy that carried me through.

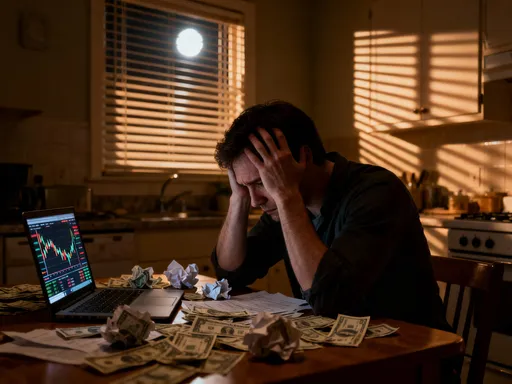

The Moment It Hit: When Income Disappears, Emotions Take Over

The moment the termination notice arrived, time seemed to slow. One second, life was predictable—bills paid on schedule, retirement contributions automatic, future plans taking shape. The next, uncertainty flooded in. The immediate concern wasn’t just how to cover rent or groceries, but what to do with the investments that had quietly grown over the years. For many, this is when emotions override logic. Fear triggers a reflex: either sell everything to “play it safe” or, conversely, double down on risky bets in hopes of a fast rebound. Neither response is grounded in sound financial planning.

Psychological studies consistently show that job loss amplifies financial stress, which in turn distorts decision-making. When the brain perceives threat, the prefrontal cortex—responsible for rational thinking—becomes less active, while the amygdala, which governs fear and survival instincts, takes over. This neurological shift explains why so many people make impulsive financial moves during unemployment. They act not out of strategy, but out of anxiety. A portfolio that was built over a decade can be unraveled in days if emotion drives the decisions.

What I realized in those first few days was that my investments were not the problem. The problem was the story I was telling myself: that every dollar lost in the market was a personal failure, that pausing contributions meant falling behind forever. These beliefs, while common, are misleading. Markets are cyclical. Careers are not linear. A single income interruption does not erase years of disciplined saving. The first and most important step in protecting wealth during a job loss is recognizing that emotional reactions are temporary—but financial consequences can last much longer. Gaining mental clarity meant stepping back, not acting out.

Why Investment Rhythm Matters More Than Returns in Crisis

When markets are rising, investors tend to focus on performance—how much their portfolios have grown, which funds are outperforming, whether they should shift into higher-return assets. But during a crisis, that focus shifts from returns to survival. What matters most is not how much money you make, but how you avoid losing what you already have. This is where the concept of investment rhythm becomes critical. Rhythm refers to the pattern of your financial behavior: how often you check your accounts, when you make trades, how frequently you reassess your strategy. In times of stress, a steady rhythm acts as an anchor.

Consider two investors facing the same market drop during unemployment. One checks their portfolio daily, reacts to every fluctuation, and makes impulsive trades based on headlines. The other has a structured approach: they review their holdings monthly, follow a predetermined plan, and avoid reacting to short-term noise. Over time, the second investor is far more likely to preserve capital, even if both started with identical portfolios. The difference isn’t intelligence or resources—it’s discipline.

Intentional investing means making decisions based on goals, timelines, and facts—not moods or market swings. It means understanding that volatility is normal, and that panic-selling locks in losses. A steady rhythm also includes routines like scheduled check-ins, automated contributions (when possible), and regular rebalancing. During unemployment, maintaining this rhythm—even if scaled back—helps prevent emotional decision-making. It creates space between stimulus and response, allowing for reflection rather than reaction. In this way, rhythm becomes a form of risk management, not just a scheduling tool.

Freezing the Portfolio: The First Smart Move You’re Not Making

When income stops, the instinct is to do something. Many people feel compelled to adjust their investments immediately—sell off risky assets, shift into cash, or reallocate to “safer” options. But often, the best move is no move at all. A temporary investment freeze—pausing contributions, avoiding withdrawals, and resisting the urge to restructure—can be one of the most effective strategies during unemployment. This pause is not inaction; it’s a deliberate strategy to prevent emotional interference.

A freeze allows time to assess the real picture. How long will savings last? What are the actual expenses? Is there a possibility of severance or temporary work? Answering these questions takes time, and making investment decisions before clarity is reached can lead to irreversible mistakes. For example, selling equities during a market dip to raise cash may seem prudent, but it locks in losses and undermines long-term growth potential. Once sold, those assets are gone, and re-entering the market at higher prices later becomes harder.

Moreover, a freeze protects against overcorrection. In moments of stress, people often overestimate risk and underestimate resilience. They assume the worst-case scenario will last indefinitely, leading them to abandon long-term strategies for short-term comfort. But economic downturns, like job losses, are typically temporary. A well-diversified portfolio is designed to weather such periods. By freezing changes, investors give themselves time to distinguish between genuine financial need and emotional impulse. This buffer period also allows space to consult with a financial advisor, review options, and develop a plan—rather than reacting in isolation.

Mapping Your Runway: Aligning Investments With Real Survival Time

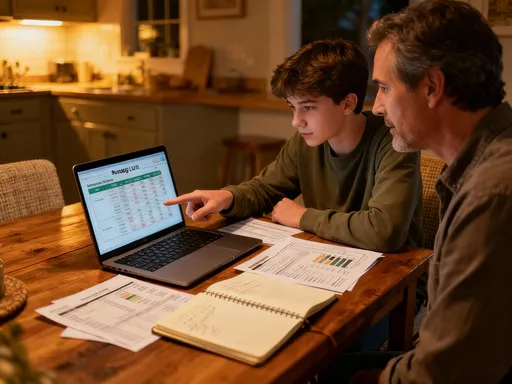

One of the most empowering steps after job loss is calculating your financial runway—the number of months your savings and resources can cover essential expenses without new income. This number transforms abstract anxiety into concrete planning. It answers the question: How much time do I really have? Knowing this timeline allows you to align your investment decisions with reality, rather than fear.

To calculate your runway, start by listing all liquid assets: checking and savings accounts, emergency funds, and any accessible investment accounts. Next, subtract any immediate obligations, such as outstanding bills or debt payments. Then, divide the remaining balance by your monthly essential expenses—rent, utilities, groceries, insurance, and minimum debt payments. The result is your runway in months. For example, if you have $30,000 in accessible funds and $3,000 in monthly essentials, your runway is ten months.

This number is crucial because it determines your investment strategy. If your runway is short—say, three to six months—liquidity becomes the priority. You may need to rely on cash reserves and avoid tapping into long-term investments. In such cases, preserving capital is more important than growth. But if your runway is longer—nine months or more—you have the luxury of patience. You can afford to leave growth-oriented investments untouched, allowing them to recover over time. This distinction prevents the common mistake of liquidating stocks or mutual funds prematurely, simply because the timeline wasn’t clearly understood.

Additionally, the runway calculation should include potential income sources, such as unemployment benefits, freelance work, or spousal support. Even irregular income can extend your timeline and reduce pressure on investments. The goal is not to stretch savings indefinitely, but to make informed choices based on actual numbers, not emotion.

The Withdrawal Strategy That Won’t Kill Your Comeback

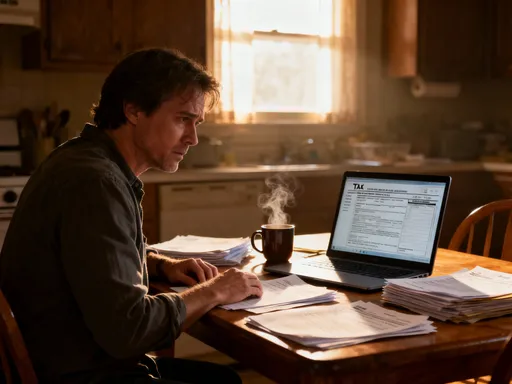

When income stops, accessing money from investments may become necessary. But how you withdraw funds can significantly impact your financial recovery. A poorly planned withdrawal can deplete growth assets, trigger unnecessary taxes, and undermine future stability. A structured approach, however, can meet immediate needs without sacrificing long-term security.

The key is to follow a hierarchy of sources. First, use cash reserves. Emergency funds exist for this purpose—covering essential expenses without touching investments. Once cash is exhausted, consider low-volatility assets such as bonds, money market funds, or dividend-paying stocks that can be sold with minimal market impact. These assets tend to be more stable and less sensitive to short-term swings, making them safer sources of liquidity.

Avoid selling high-growth holdings—such as individual stocks or equity mutual funds—unless absolutely necessary. These assets are the engine of long-term wealth building. Selling them during a downturn locks in losses and reduces your ability to benefit from future market recoveries. If you must sell, do so in small, planned increments rather than large, emotional liquidations.

Tax implications also matter. Withdrawals from taxable brokerage accounts may incur capital gains taxes, while early withdrawals from retirement accounts like 401(k)s or IRAs can trigger penalties and income taxes. Whenever possible, prioritize taxable accounts over retirement funds. If using retirement accounts, explore exceptions—such as those under the CARES Act during economic hardship—that allow penalty-free withdrawals up to certain limits. Even then, treat retirement funds as a last resort, preserving them for true emergencies.

Finally, document every withdrawal and its purpose. This creates accountability and helps prevent overspending. It also makes it easier to restart contributions later, knowing exactly which assets were used and how much needs to be rebuilt.

Rebalancing Without Risking It All: A Gentle Reset

Over time, market movements can shift your portfolio away from its original allocation. During unemployment, this drift may feel alarming—especially if equities have dropped and bonds now make up a larger share. The instinct might be to aggressively rebalance, selling bonds to buy stocks at lower prices. But such moves carry risk, especially when income is uncertain.

Instead of large-scale rebalancing, a gentler approach is often wiser. This involves modest adjustments using available cash flows—such as unemployment benefits or side income—to gradually restore balance. For example, if stocks are underweight, direct small amounts of incoming funds into equity index funds rather than selling bonds to buy shares. This method avoids forced sales and reduces exposure to market timing risks.

Another option is to use dividend reinvestments to nudge the portfolio back toward target. If you hold dividend-paying stocks or funds, choosing to reinvest those payments into underweight asset classes can help maintain alignment over time. This approach is passive, low-cost, and avoids emotional decision-making.

The goal is not perfection, but progress. A portfolio that is slightly off target is still functional. What matters is avoiding drastic moves that could backfire if markets continue to fluctuate. Rebalancing during unemployment should be about maintenance, not transformation. It’s a way to stay aligned with long-term goals without introducing new risks during a vulnerable period.

Rebuilding Confidence—And Capital—When the Job Hunt Ends

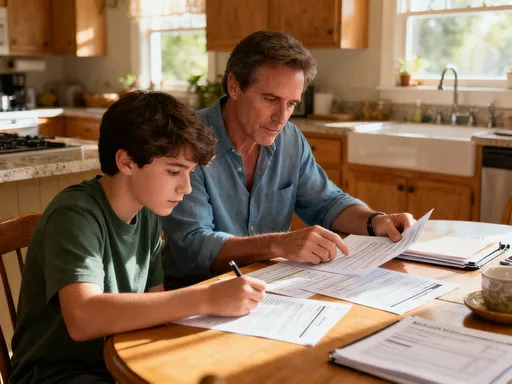

Landing a new job brings relief, but financial recovery doesn’t happen overnight. The transition back to stability requires intentionality. The first step is to rebuild your emergency fund, especially if it was depleted during unemployment. A strong cash buffer restores peace of mind and reduces future reliance on investments during income gaps.

Next, reassess your risk tolerance. The experience of job loss may have changed your perspective on financial security. You might prefer a more conservative allocation, or you may realize the importance of diversified income streams. Update your investment plan to reflect these insights, ensuring it aligns with your current life stage and goals.

Restarting contributions should be gradual. Begin with a manageable percentage of income, even if it’s below your previous level. Consistency matters more than size. Automating contributions ensures they happen regularly, reducing the temptation to delay or skip them. Over time, as confidence and cash flow improve, you can increase the amount.

Finally, reflect on what you learned. The period of unemployment, while difficult, likely revealed strengths—resilience, discipline, clarity—that can inform future decisions. Use this experience to build a more adaptable financial strategy, one that includes contingency plans, regular runway assessments, and emotional safeguards. Wealth isn’t just about numbers in an account. It’s about the ability to weather storms with calm and purpose. By focusing on rhythm, discipline, and patience, you don’t just survive a job loss—you emerge stronger, wiser, and more prepared for whatever comes next.