How I Navigated a Debt Crisis Using Market Smarts — Real Talk

I remember staring at my bills, feeling trapped by debt I couldn’t seem to outrun. It wasn’t just stress — it was panic. But instead of giving up, I turned to market trends to guide my way out. What I learned changed everything: timing, awareness, and small strategic shifts make a massive difference. This isn’t theory — it’s what actually worked when I was in deep. By paying attention to economic signals most people overlook, I refinanced at the right moment, prioritized debts more effectively, and built a cushion that kept me from falling back. If you’re overwhelmed by debt, know this: you’re not alone, and there is a way forward — one that doesn’t rely on miracles, but on smart, informed choices.

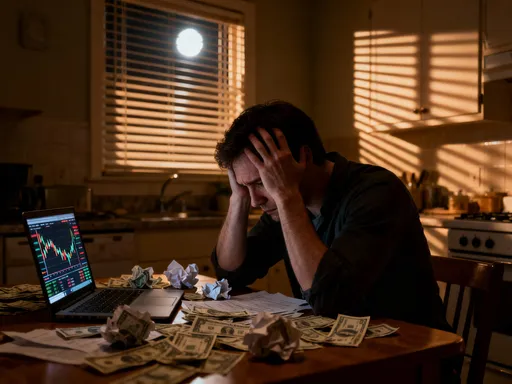

The Breaking Point: When Debt Feels Like a Trap

There comes a moment when the numbers stop being abstract and start feeling like chains. For many, it begins quietly — a credit card payment here, a medical bill there — until suddenly, every paycheck vanishes before it lands. That was my reality. I wasn’t reckless with money, but life had a way of stacking unexpected costs: car repairs, home maintenance, a temporary drop in income. Each small expense added up, and before I knew it, I was juggling multiple high-interest balances with no clear path to freedom. The emotional weight was just as heavy as the financial burden. I felt ashamed, isolated, and afraid to even open my statements. Sleep became elusive, replaced by late-night calculations that never seemed to add up in my favor.

What made it worse was the sense of helplessness. I had tried budgeting, cutting back on extras, and making minimum payments — but the debt wasn’t shrinking. In fact, it was growing. Interest charges piled on, and every time I thought I was gaining ground, another expense knocked me back. The psychological toll was real. Studies show that financial stress can affect mental health, relationships, and even physical well-being. But what I eventually realized was that I was fighting the battle with only half the tools. Budgeting and discipline are essential, yes — but they aren’t enough when the broader financial environment is working against you. That’s when I began to look beyond my personal spending and started paying attention to what was happening in the economy at large.

Many people in similar situations don’t make that shift. They blame themselves, tighten their belts further, and hope for a windfall. But the truth is, personal finance doesn’t exist in a vacuum. Interest rates, inflation, job markets — these forces shape how hard or easy it is to manage debt. Ignoring them is like trying to swim upstream without noticing the current. My breaking point became a turning point not because I suddenly earned more, but because I started thinking differently. I stopped seeing debt as purely a personal failure and began to understand it as a financial condition influenced by larger, predictable trends. That shift in perspective opened the door to solutions I hadn’t considered before.

Why Market Awareness Matters in a Debt Crisis

When you’re buried in debt, the idea of tracking economic trends might seem like a luxury — something for investors or business owners, not someone struggling to make the minimum payment. But the reality is that market conditions directly impact your borrowing costs, repayment capacity, and financial options. Inflation, for example, doesn’t just affect grocery prices; it influences how much your debt grows over time. When inflation rises, lenders often respond by increasing interest rates, which means your variable-rate credit cards or loans become more expensive. If you’re unaware of these shifts, you could be walking into higher payments without realizing why.

Interest rate trends are especially critical. The Federal Reserve’s decisions on benchmark rates ripple through the economy, affecting everything from mortgage payments to credit card APRs. During periods of rising rates, carrying high-interest debt becomes significantly more costly. Conversely, when rates stabilize or decline, opportunities emerge to reduce your burden. But you have to be watching to see them. I learned this the hard way when my credit card rate jumped by nearly three percentage points in a single billing cycle. It wasn’t a mistake — it was a direct result of Federal Reserve policy changes. That moment was a wake-up call: if I didn’t understand how these forces worked, I’d always be reacting instead of planning.

Employment trends also play a role. A strong job market can provide stability, making it easier to maintain income and avoid taking on new debt. But when layoffs rise or hiring slows, financial vulnerability increases. Being aware of these patterns allows you to prepare — perhaps by building savings when the economy is strong or avoiding new commitments when uncertainty looms. Market awareness isn’t about predicting the future perfectly; it’s about reducing surprise. It’s the difference between being blindsided by a rate hike and adjusting your strategy in time to avoid it. For someone in debt, that foresight can mean the difference between progress and stagnation.

Moreover, understanding economic cycles helps you avoid common traps. For instance, during periods of low interest rates, lenders often promote balance transfer offers or personal loans with attractive terms. These can be powerful tools — but only if used wisely. Without market context, you might take on a new loan without realizing that rates are expected to rise soon, locking you into a short promotional period followed by steep increases. By staying informed, you can time your moves more strategically, using favorable conditions to your advantage rather than falling into the next debt cycle.

Reading the Signs: Spotting Financial Shifts Early

You don’t need a finance degree to track the economic signals that matter. What you do need is a basic understanding of where to look and what to watch for. The good news is that many of these indicators are widely reported and easy to access. Consumer price indexes, for example, are released monthly and show how quickly inflation is rising. A steady increase means your cost of living is going up — and lenders are likely to respond by raising rates. Job market reports, like the monthly employment situation summary, tell you whether hiring is strong or slowing. More jobs usually mean more financial stability for households, but it can also signal to the Federal Reserve that they may need to cool the economy by raising interest rates.

Another key signal is the prime rate — the interest rate banks charge their most creditworthy customers. When the prime rate moves, it often affects home equity lines, credit cards, and adjustable-rate loans. Many people don’t realize their credit card APR is tied to this rate, so when it goes up, their payments do too. By monitoring financial news or setting up alerts from trusted sources, you can see these changes coming. I started following a few reliable economic blogs and signing up for monthly summaries from the Bureau of Labor Statistics. It didn’t take much time — just 15 minutes a month — but it gave me early warnings that made a big difference.

One of the most useful tools I discovered was the Federal Reserve’s interest rate projections. Published quarterly, these dot plots show where policymakers expect rates to be in the coming months and years. While not guarantees, they provide valuable insight into the likely direction of borrowing costs. When I saw projections pointing to rate cuts in the next year, I knew it might be worth waiting before refinancing. When the outlook showed continued hikes, I knew it was time to act fast to lock in better terms. This kind of forward-looking information helped me move from reactive to proactive.

Even everyday observations can serve as early warnings. Are banks suddenly advertising balance transfer deals with 0% interest for 18 months? That often happens when they’re trying to attract customers before rates go up. Are auto lenders offering longer loan terms or lower down payments? That could signal a competitive market, but it might also mean riskier lending practices ahead. Paying attention to these patterns helps you see the bigger picture. The goal isn’t to become an economist — it’s to become a more informed borrower. And that awareness gives you power, especially when you’re trying to climb out of debt.

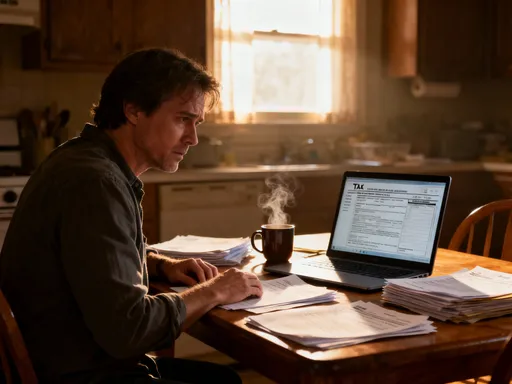

Turning Data into Action: Debt Refinancing at the Right Time

Refinancing isn’t just about finding a lower rate — it’s about timing it right. I used to think refinancing was something you did when you could no longer afford your payments. But I learned it’s actually most effective when you’re still in control, using favorable market conditions to reduce long-term costs. The key is to act when interest rates are falling or stable, not when they’re rising. When I finally understood this, I refinanced two credit card balances into a personal loan with a fixed rate that was nearly half of what I was paying. The monthly payment was only slightly higher, but the total interest over time would be thousands of dollars less.

The process starts with evaluating your current debt. List each balance, its interest rate, and the repayment term. Then, compare those terms to what’s available in the current market. Online lenders, credit unions, and banks often offer personal loans with fixed rates that can be more predictable than credit card debt. The best opportunities usually appear during economic slowdowns or periods of monetary easing, when lenders compete for borrowers by offering better terms. I waited until I saw clear signs that the Federal Reserve was pausing rate hikes before applying — and that timing improved my chances of approval and better rates.

Credit score matters, but so does timing. Even with a solid score, applying during a period of rising rates means fewer options and higher costs. By waiting for a more favorable environment, I qualified for a loan with a rate I wouldn’t have gotten six months earlier. And because the rate was fixed, I didn’t have to worry about it increasing later. That predictability made budgeting easier and gave me confidence that I was making real progress.

It’s also important to avoid refinancing mistakes. Some people transfer balances to a 0% introductory rate card but don’t pay it off before the promotional period ends — then get hit with high interest. Others consolidate debt but keep using their old cards, digging a new hole. My approach was different: I closed the old accounts after transferring, and I treated the new loan like a strict repayment plan. No new charges, no delays. The goal wasn’t to shuffle debt around — it was to reduce it. By aligning my refinancing decision with market conditions, I turned a short-term move into a long-term win.

Strategic Payoff: Prioritizing Debts Based on Market Conditions

Not all debts should be treated the same — especially when economic conditions are shifting. I used to follow the standard advice: pay off the smallest balance first for quick wins. But I realized that strategy didn’t account for how different types of debt behave in changing markets. Variable-rate debt, like credit cards or adjustable-rate loans, becomes more dangerous when interest rates rise. Fixed-rate debt, like a traditional auto loan, stays predictable. That means in a rising rate environment, it makes more sense to prioritize high-interest, variable-rate balances — even if they’re larger — because their cost could increase at any time.

I developed a simple framework: rank debts by interest rate type and current APR, then adjust based on market outlook. If rates are rising, focus on variable-rate debt first. If rates are falling, you might have more flexibility, but it’s still wise to tackle the highest-cost debt. I also considered the consequences of non-payment. Secured debts, like a mortgage or car loan, carry bigger risks if missed — potential repossession or foreclosure — so they require more attention even if the rate is lower. Unsecured debts, like credit cards, don’t put assets at risk, but their high rates can spiral quickly.

This approach helped me allocate limited funds more effectively. Instead of spreading payments evenly, I concentrated on the debts that posed the greatest financial threat given the current economic climate. For example, when I saw that credit card rates were likely to rise further, I shifted extra money toward those balances, even though they weren’t the smallest. That decision saved me hundreds in interest over the next year. At the same time, I maintained minimum payments on other accounts to avoid penalties.

Market conditions also influenced whether I paid off debt or built savings. In times of economic uncertainty, I prioritized creating a small emergency fund to avoid relying on credit for unexpected expenses. Once stability returned, I shifted more aggressively toward debt reduction. This dynamic approach — adjusting priorities based on external factors — gave me more control than a rigid, one-size-fits-all method ever could.

Building Buffers: Using Market Lulls to Strengthen Finances

When the economy stabilizes — inflation slows, job markets remain strong, and interest rates hold steady — it creates a window of opportunity. These periods of calm are not the time to relax financially; they’re the time to strengthen your position. I learned to use these lulls to build emergency savings, pay down extra debt, and improve my credit score. When I had a stretch of stable income and no major rate increases, I redirected some of my debt payments into a high-yield savings account. It wasn’t a large amount, but it created a cushion that gave me breathing room.

Having even a small emergency fund changes your relationship with debt. Instead of reaching for a credit card when the water heater breaks, you can cover it without adding to your balance. That single shift broke the cycle of recurring debt that had trapped me for years. I aimed for three to six months of essential expenses saved, but I started with just $500. The key was consistency — setting up automatic transfers so saving happened without effort.

Market stability also allowed me to focus on credit improvement. I paid all bills on time, kept credit utilization low, and avoided new hard inquiries. A stronger credit profile meant better terms when I eventually refinanced or needed a loan. And because I built this foundation during a calm period, I was better prepared when the next economic shift came. I wasn’t caught off guard by a rate hike or job loss — I had tools to respond.

These buffers don’t eliminate risk, but they reduce vulnerability. They turn financial shocks from crises into manageable challenges. And that sense of security is priceless. I no longer feel like one unexpected expense will ruin everything. That peace of mind is one of the most valuable outcomes of my journey — not just because it protects my finances, but because it improves my daily life.

Staying Smart: Long-Term Habits Beyond the Crisis

Getting out of debt isn’t a finish line — it’s a starting point. The habits I developed during my crisis have become permanent parts of my financial life. I still review economic reports monthly. I still track interest rate trends. I still adjust my strategy based on what’s happening in the broader economy. Financial resilience isn’t about reaching a number and stopping; it’s about staying aware, staying flexible, and staying in control.

I’ve also changed how I think about money. It’s no longer just about survival — it’s about intention. Every decision, from using a credit card to saving for a goal, is made with awareness of both personal habits and market realities. I don’t ignore sales or discounts, but I also don’t chase low rates without understanding the bigger picture. I’ve learned to balance caution with confidence, knowing that I have the tools to navigate challenges.

The confidence I’ve gained is perhaps the most lasting benefit. I no longer feel powerless when the economy shifts. I see changes as signals, not threats. I understand that I can’t control interest rates or inflation — but I can control how I respond. That mindset has transformed not just my finances, but my sense of self-reliance. I share what I’ve learned with friends and family, not as a guru, but as someone who’s been through it and found a way.

If you’re in debt today, know that it doesn’t define you. What matters is what you do next. Start by looking up, not just down at your bills. Pay attention to the world around you. Learn the signals. Use them to make smarter choices. You don’t need a windfall or a miracle — you just need awareness, timing, and the courage to act. The path out of debt isn’t easy, but it is possible. And with the right tools, it can lead to a stronger, more secure future.