Beyond the Grind: How I Optimized My Returns Without Losing Sleep

Ever felt like you're chasing returns but going nowhere? I’ve been there—stuck in the cycle of chasing yields, only to watch risks pile up. Then I shifted focus: not just earning more, but optimizing what I keep. It’s not about aggressive bets; it’s smarter systems. In this article, I’ll walk you through how refining strategies, managing downside, and fine-tuning decisions transformed my path to financial freedom—without the burnout. The journey wasn’t about finding a magic formula or outsmarting the market. It was about stepping back, redefining success, and building a process that works consistently, quietly, and sustainably. What matters most isn’t the headline return, but what you actually get to keep, how calmly you sleep at night, and whether your plan survives not just a bull market, but life itself.

The Hidden Cost of Chasing High Returns

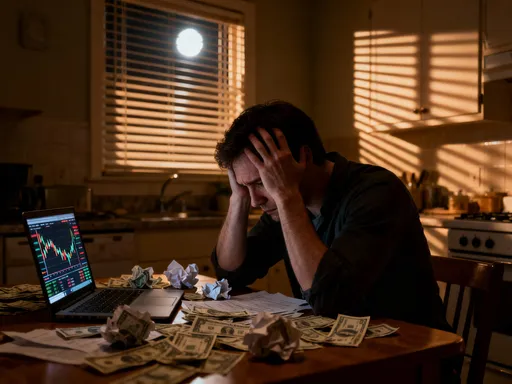

Many investors measure success by the size of their returns, believing that higher numbers always mean better outcomes. But this mindset overlooks a critical truth: not all gains are created equal, and the pursuit of high returns often comes with hidden costs that erode long-term wealth. Volatility, stress, and emotional decision-making can quietly undermine even the most impressive performance figures. When investors focus solely on maximizing upside, they often expose themselves to outsized risk, leading to sleepless nights, impulsive trades, and, ultimately, subpar results. The real cost of chasing returns isn’t just financial—it’s psychological, emotional, and behavioral.

Consider the investor who shifts money into a high-flying tech stock after seeing a 50% gain in six months. On paper, the move looks brilliant. But when the market corrects, that same stock drops 30%, and fear takes over. Instead of holding or rebalancing, the investor sells at a loss, locking in the damage. This pattern—buying high, selling low—is one of the most common wealth destroyers in personal finance. It’s not due to a lack of intelligence, but to the emotional toll of riding volatile assets without a disciplined framework. The constant monitoring, the fear of missing out, and the pressure to time the market create a cycle of stress that makes sustained success nearly impossible.

Another hidden cost is opportunity cost. When capital is tied up in speculative investments, it’s not working in more stable, diversified assets that compound steadily over time. An investor chasing a 20% return might ignore a 7% return with low volatility, not realizing that after adjusting for risk and behavior, the lower-return option often delivers better long-term outcomes. Research shows that the average investor underperforms the market not because of poor stock selection, but because of poor timing—largely driven by emotional reactions to volatility. This underperformance, known as the “behavior gap,” can cost hundreds of thousands of dollars over a lifetime.

The solution isn’t to avoid growth investments altogether, but to approach them with intention and balance. Sustainable wealth building requires a shift from performance chasing to outcome optimization. That means prioritizing strategies that reduce drawdowns, minimize emotional interference, and align with long-term goals. Instead of asking, “How much can I make this year?” the better question is, “How can I grow my wealth reliably, without jeopardizing my peace of mind?” When you stop measuring success by short-term gains and start focusing on net results after risk and behavior, a new path to financial freedom emerges—one built on consistency, not heroics.

Rethinking “Good” Returns: Quality Over Quantity

What makes a return truly “good”? Most people assume it’s the size—the bigger the number, the better. But in reality, the quality of a return matters far more than its quantity. A 15% return earned through reckless risk-taking may feel rewarding in the moment, but if it comes with a 40% drawdown, the emotional and financial toll can outweigh the gain. Conversely, a 7% annual return with minimal volatility can lead to far greater wealth over time, especially when compounded consistently and without disruption. The key is to evaluate returns not in isolation, but relative to the risk taken to achieve them.

This is where the concept of risk-adjusted returns becomes essential. It’s not enough to know how much you made; you must also understand how much risk you took to get there. A useful analogy is two drivers taking different routes to the same destination. One takes a winding mountain road at high speed—faster, but with a high chance of an accident. The other takes a steady highway, arriving more slowly but safely. Over many trips, the second driver is more likely to reach their destination without incident. In investing, the goal isn’t to win a single race, but to stay on the road for decades. That requires a focus on sustainability, not speed.

One way to measure risk-adjusted returns is through tools like the Sharpe ratio, which compares excess return to volatility. But you don’t need complex math to apply this principle. Simply ask: does this investment behave wildly, or does it move in a predictable, manageable way? Does it lose value sharply when the market dips, or does it hold up reasonably well? High-quality returns come from assets that grow steadily, recover quickly from losses, and allow you to stay invested without panic. These are the returns that compound effectively, because they aren’t interrupted by emotional sell-offs or forced withdrawals.

Asset allocation plays a crucial role in generating high-quality returns. A portfolio that blends growth-oriented assets like equities with stability-focused assets like high-quality bonds can deliver smoother performance over time. The equity portion provides long-term appreciation, while the bonds act as a stabilizer during market stress. This balance allows investors to capture market gains without being wiped out by downturns. Moreover, consistent returns enable reinvestment—dividends, interest, and capital gains can be put back to work without the need to time the market. Over time, this reinvestment accelerates compounding, creating a self-sustaining cycle of growth.

The pursuit of quality returns also means avoiding the trap of performance chasing. When an asset class has a hot streak—such as cryptocurrencies in 2017 or tech stocks in the late 1990s—investors often pile in at the peak, only to suffer when the trend reverses. A disciplined approach means sticking to a strategic allocation, rebalancing as needed, and avoiding the temptation to chase what’s working today. This doesn’t mean ignoring opportunities, but evaluating them within the context of your overall plan. A good return isn’t one that looks impressive in a headline—it’s one that fits your risk tolerance, time horizon, and long-term objectives.

Diversification Done Right: Beyond Just Spreading Risk

Diversification is often described as the only free lunch in investing, but many investors misunderstand what it truly means. Simply owning multiple stocks or funds does not guarantee protection. True diversification isn’t about quantity—it’s about quality of exposure. It’s about combining assets that respond differently to the same economic conditions, so that when one part of the portfolio struggles, another may hold steady or even gain. This reduces overall volatility and increases the likelihood of consistent returns over time.

Consider two investors. The first owns ten different technology stocks, all tied to the same sector and driven by similar growth narratives. The second owns a mix of U.S. stocks, international equities, real estate investment trusts, long-term bonds, and commodities. When a tech-led market correction occurs, the first investor suffers broad losses, despite holding “many” stocks. The second investor experiences a smaller impact, as other assets help offset the decline. This is the power of true diversification: it’s not about how many holdings you have, but how they interact with each other.

One key principle is correlation awareness. Assets with low or negative correlation tend to move independently, which helps smooth portfolio performance. For example, when stock markets fall, high-quality government bonds often rise as investors seek safety. Similarly, commodities like gold may perform well during periods of inflation, while stocks struggle. By intentionally combining uncorrelated assets, investors can create a more resilient portfolio that withstands different market environments—growth, recession, inflation, or deflation.

Geographic diversification is another critical component. Relying solely on one country’s economy exposes investors to concentrated risk. For instance, a U.S.-only portfolio missed out on strong performance from international markets in certain periods, while also suffering more during U.S.-specific downturns. Allocating to developed and emerging markets abroad provides exposure to different growth cycles, currencies, and policy environments. This doesn’t guarantee outperformance, but it reduces dependence on any single economy.

Income stream layering is another dimension of advanced diversification. Instead of relying on one source of return—such as stock price appreciation—investors can build multiple streams: dividends, bond interest, rental income, and business profits. This not only enhances stability but also provides flexibility. During market downturns, when capital gains may be negative, income from dividends or rent can continue to flow, allowing investors to avoid selling assets at a loss. Over time, reinvesting this income accelerates compounding, further strengthening the portfolio’s growth potential.

Effective diversification also means avoiding “fake” diversification—such as owning multiple mutual funds that hold the same underlying stocks, or investing in thematic ETFs that overlap significantly. True diversification requires looking under the hood, understanding what you actually own, and ensuring your portfolio isn’t secretly concentrated in a few sectors or factors. It’s a continuous process, not a one-time decision, and it requires periodic review and adjustment as markets and personal circumstances evolve.

The Power of Rebalancing: Discipline Over Emotion

Markets are unpredictable, and portfolios change over time. Left unmanaged, a carefully constructed asset allocation can drift significantly, exposing investors to more risk than intended. This is where rebalancing becomes a powerful tool—not for boosting returns, but for managing risk and maintaining discipline. Rebalancing means periodically adjusting your portfolio back to its target allocation, selling assets that have grown too large and buying those that have fallen behind. It’s a counterintuitive strategy: selling high and buying low, systematically and without emotion.

Imagine an investor with a 60% stock, 40% bond allocation. Over a strong bull market, stocks surge, and their share of the portfolio grows to 75%, while bonds shrink to 25%. The investor now has more exposure to equities than planned, increasing vulnerability to a market correction. Without rebalancing, they’re effectively making a bold, unplanned bet on continued stock market gains. By selling some stocks and buying bonds, the investor locks in gains from the winners and reinvests in the laggards, restoring balance and discipline.

This process does more than manage risk—it also enhances long-term returns. When you sell appreciated assets, you take profits. When you buy underperforming assets, you acquire them at lower prices, positioning for potential recovery. Over time, this disciplined approach can improve compounding by preventing overconcentration in overvalued areas. Studies have shown that regularly rebalanced portfolios often outperform unrebalanced ones, not because they pick winners, but because they avoid the pitfalls of drift and emotional decision-making.

Rebalancing also helps investors stay aligned with their risk tolerance. A portfolio that drifts too far into stocks may feel uncomfortable during a downturn, leading to panic selling at the worst possible time. By maintaining a consistent allocation, investors are more likely to stick with their plan through market cycles. This behavioral benefit is often more valuable than any marginal gain in performance. Knowing that your portfolio is structured according to a clear, rules-based strategy makes it easier to stay calm when others are reacting emotionally.

How often should you rebalance? There’s no one-size-fits-all answer, but most financial advisors recommend doing it annually or when allocations deviate by more than 5% from targets. Some investors use a time-based approach, while others use a threshold-based method. The key is consistency and automation—setting up rules in advance removes the need for constant monitoring and decision-making. Many brokerage platforms now offer automated rebalancing tools, making it easier than ever to maintain discipline without effort.

Minimizing the Silent Killers: Fees, Taxes, and Timing Errors

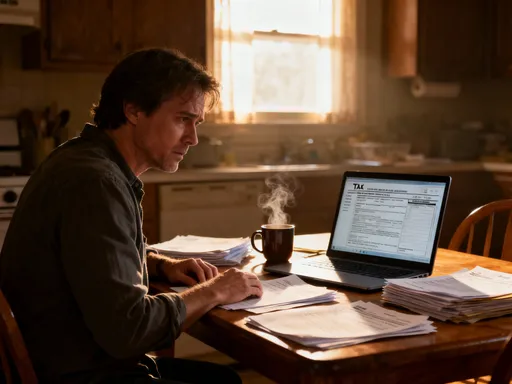

High returns look impressive on a statement, but what matters is what you keep after fees, taxes, and behavioral mistakes. These three factors—often overlooked—can silently erode wealth over time, turning strong performance into mediocre results. A return of 8% before costs may deliver only 5% or less after expenses, and the difference compounds dramatically over decades. Understanding and minimizing these silent killers is essential for optimizing long-term outcomes.

Fees are the most visible but often underestimated drag on returns. Mutual funds, advisory services, and trading platforms all charge fees, sometimes hidden in complex structures. A 1% annual expense ratio may seem small, but over 30 years, it can reduce portfolio value by 25% or more compared to a low-cost alternative. Index funds and exchange-traded funds (ETFs) have revolutionized investing by offering broad market exposure at a fraction of the cost of actively managed funds. Choosing low-cost options doesn’t guarantee outperformance, but it significantly improves the odds by keeping more of your returns.

Taxes are another major factor, especially in taxable accounts. Every time you sell an asset at a profit, you may owe capital gains tax. Frequent trading can lead to high tax bills, reducing net returns. Tax-efficient strategies—such as holding investments longer to qualify for lower long-term rates, using tax-advantaged accounts like IRAs and 401(k)s, and practicing tax-loss harvesting—can make a substantial difference. Tax-loss harvesting, for example, involves selling underperforming assets to offset gains elsewhere, reducing your tax bill without changing your overall strategy.

Timing errors are perhaps the most damaging. Buying after a market rally and selling during a downturn is a common pattern, driven by emotion rather than logic. These mistakes can cut long-term returns in half, even if the underlying investments perform well. One study found that the average investor earned less than half the return of the S&P 500 over a 20-year period, not because of poor choices, but because of poor timing. Automating contributions and rebalancing helps eliminate this risk, ensuring that decisions are made systematically, not reactively.

The cumulative impact of fees, taxes, and timing can be staggering. Two investors with identical portfolios and returns can end up with vastly different outcomes based on how well they manage these factors. The winner isn’t the one who picks the best stocks, but the one who keeps the most of what they earn. That’s the essence of intelligent investing: not chasing the highest pre-cost return, but maximizing the after-cost result.

Building Income That Works While You Sleep

Financial freedom isn’t just about accumulating a large number on a balance sheet—it’s about generating reliable income that covers your life without requiring constant effort. The goal is to build a portfolio that produces cash flow automatically, allowing you to maintain your lifestyle without depending on a paycheck. This is the power of passive income: money that works for you, even when you’re not working.

There are several ways to generate passive income, each with different risk and return profiles. High-quality bonds pay regular interest, providing predictable income with relatively low volatility. Dividend-paying stocks, especially those from established companies with a history of increasing payouts, offer both income and growth potential. Real estate investments, whether direct ownership or through REITs, can generate rental income while also appreciating in value. Each of these assets plays a role in a well-structured income portfolio.

The key is sustainability. A high headline yield can be tempting, but if it’s not supported by strong fundamentals, it may be cut or eliminated. For example, a stock paying a 10% dividend may seem attractive, but if the company is losing money, that payout is unlikely to last. Focusing on quality—companies with strong cash flow, bonds with high credit ratings, properties in stable markets—ensures that income continues through economic cycles.

Reinvesting early income is a powerful accelerator. In the early years, the cash flow may be modest, but by reinvesting it, you buy more income-producing assets, which in turn generate more income. This compounding effect grows exponentially over time, transforming a small initial portfolio into a significant income stream. The goal isn’t to live off the income immediately, but to let it build momentum, creating a self-reinforcing cycle of growth.

Automation is essential for consistency. Setting up automatic dividend reinvestment, bond ladders, or rental income collection ensures that the system runs smoothly without daily attention. This allows investors to focus on their lives, not their portfolios. True financial freedom comes not from constant monitoring, but from having a reliable, low-maintenance system that delivers results over time.

The Long Game Mindset: Staying the Course Without Burnout

Even the best investment strategy fails if you don’t stick with it. The greatest challenge in personal finance isn’t finding the right stocks or funds—it’s maintaining discipline through market noise, economic uncertainty, and personal doubts. This is where the long game mindset becomes essential. It’s about designing a plan that’s not just smart, but sustainable—one that fits your personality, lifestyle, and emotional capacity.

Realistic expectations are the foundation of endurance. If you expect 15% annual returns, you’ll be disappointed when the market delivers 7%, and you may be tempted to chase higher returns. But 7% compounded over 30 years turns $100,000 into over $760,000—more than enough for many people to achieve financial independence. Accepting that wealth building is slow, steady, and unexciting removes the pressure to “do something” when patience is the best strategy.

Comparison is another silent threat. In an age of social media, it’s easy to see others claiming huge gains from speculative investments. But what you don’t see are the losses, the stress, and the long-term consequences. Focusing on your own plan, your own goals, and your own progress protects you from this trap. Financial success isn’t a race; it’s a personal journey with a unique timeline.

Simplicity and automation are powerful allies. The more complex a strategy, the harder it is to maintain. A simple, diversified portfolio with automatic contributions and rebalancing requires minimal effort and reduces the chance of mistakes. This allows you to stay the course without burnout, even during turbulent times.

True financial freedom isn’t about constant action—it’s about having a resilient system that works quietly, consistently, and effectively over time. It’s about optimizing not just returns, but peace of mind, time, and quality of life. When you stop chasing and start building, a new kind of wealth becomes possible—one that lasts not just for years, but for generations.